Winning in crises resembles winning in growth periods

Brands that have gained share over the past few years were more active than brands that lost share

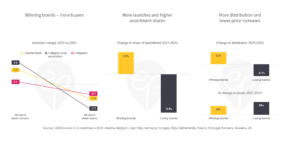

Winning brands – more buyers

Between 2021 and 2024, 35% of brands increased their share and 65% decreased it. On average, the magnitude of change was similar in both directions (about ±1 percentage point). Because more brands lost share than gained, the net effect is an overall increase in private-label (PL) share. Winning brands saw their buyer numbers increase (by 1.5% on average) and so did their purchasing frequency (by 0.2 occasions). Losing brands experienced a drop respectively. As shown numerous times before: winning share is a consequence of reaching more buyers.

More launches and higher assortment shares

The average winning brand launched 1.23 new products per year between 2021 and 2024 while the average losing brand only launched 0.84. Apart from more launch activity, the winners were by far more successful in adding to their assortment rather than replacing other items: while winners‘ value share of the brand from launches was only slightly higher (8.9%) than losers‘ (7.3%) their category assortment share increased whereas the assortment share of losers dropped.

More distribution and lower price increases

Apart from enhancing their range, winners also managed to find additional retailers listing them (which, in return, increases the odds of winning). A key distinction between winning and losing brands in the past few years was the extent to which brands increased their prices. Not surprisingly, given the financial constraints of many shoppers, brands that increased prices more were less likely to win share. While winning brands increased prices below the 28% average food inflation rate over this period, losing brands well exceeded this threshold at 35%.