Brand performance in Europe between 2019 and 2023

what we can learn from past crises for the future?

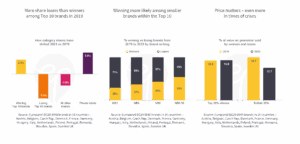

More share losers than winners among Top 10 brands in 2019

Of all Top 10 national brands across some 90 categories in 16 European markets in 2019, 45% grew their market share over the subsequent crisis years (Covid-19, inflation, economic uncertainty) while 55% experienced a decline. This imbalance is not a result of winners winning more than losers lose, but a reflection of PL winning more share than ever in this century: in the average category 3% of volume sales switched from NBs to PLs.

Winning more likely among smaller brands within the Top 10

Share gains are easier to come by if you start from a lower level. Once a brand has reached a certain size, lots of barriers to winning even more share emerge: consumers will seek some level of variety, retailers will be reluctant to offer (even) more support and competitors try to emulate the incumbent’s strategies. In essence, there is a ceiling that is hard to break. Our data reflects this phenomenon: only 3 in 10 leading brands increased their share between 2019 and 2023, while more than 4 of 10 #5 brands and more than half #6 to #10 ranked brands increased their share.

Price matters – even more in times of crises

Overall, promotion pressure dropped between 2019 and 2023 – likely a sign than manufacturers focused more on the bottom line than on volumes. We cannot judge the effectiveness of this move, but we see that top winning brands were more likely to promote at similar levels in 2023 compared to 2019 while top losing brands substantially reduced their sales on promotion. While many factors contribute to gains and losses in market share (more insights in the next few weeks), tough times seem to trigger shoppers’ responsiveness to price signals.