Winning brands 2019-2023

Penetration is key and Private Label performance links with brand share gains

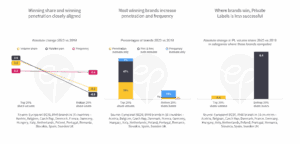

Winning share and winning penetration closely aligned

As shown for many earlier time periods, we again find a close relationship between winning (losing) market share between 2019 and 2023 and higher (lower) penetration. Share-winning brands also increase the average frequency with which they are bought while brands that lose share experience a drop in frequency. The two metrics are obviously linked: a brand with more appeal will find more buyers who (on average) will buy it more often.

Most winning brands increase penetration and frequency

Winning share through convincing existing buyers to buy a brand more often is an unlikely path to success. Why? First, many existing buyers will not buy in the next period although they may rebuy the brand later. However, these are replaced by new buyers (that is, buyers who have not bought in the previous period). Second, most category buyers will buy from a repertoire of brands with a ceiling to their overall category purchasing frequency. Our data supports this: almost all brands experiencing strong market share gains experience an increase in buyer numbers – with many also increasing their average purchase frequency. Winning brands increase their odds to be chosen on each occasion which will improve both their reach and frequency.

Where brands win, Private Labels is less successful

The past few years have seen an increase in Private Label share at unprecedented levels. That increase, which we will be illustrating in more details in future picks of the week, is not a law of nature. PL share gains vary widely and, not surprisingly, winning brands are more likely to compete in categories where PL has performed relatively worse. We can only speculate how much the performance of winning brands was a key in mitigating PL growth. The relationship is clear: the top performing brands compete in categories with almost no share gains of PL while the worst performing brands experienced an increase of 6.4% of the PL share in their category.