Winning brands 2019-2023 – Part 3

Innovation, Distribution and Pricing

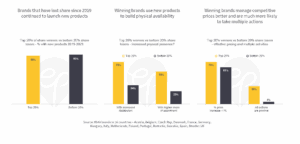

Brands that have lost share since 2019 continued to launch new products

Slightly more losing brands introduced new products than winning brands and, as already shown in last week’s edition, they introduced more of them. Put differently, about 1 in 10 brands (both in the winner and loser bucket) went five years without a launch.

Winning brands use new products to build physical availability

Alongside product introductions, a large proportion of brand share winners build distribution and a majority also build share of shelf. This is in contrast to losers who tend to see their introductions cannibalise the existing range.

Winning brands manage competitive prices better and are much more likely to take multiple actions

Private Labels have grown significantly during the recent high inflation period. Winning brands were more likely to increase prices less than PL in that period (from a higher base). A combination of actions is also much more likely – not just price but physical availability and more successful innovation.