E-Commerce in FMCG

How the ability to shop online changes behaviour

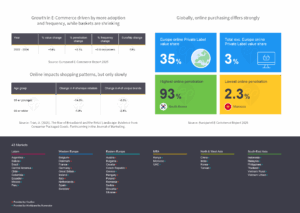

Growth in E-Commerce driven by more adoption and frequency, while baskets are shrinking

In 2024 the share of online shopping in FMCG surpassed the 10% threshold (in the 43 countries we cover). Value growth over the past two years has been substantial (14%). Besides inflation it was driven by more people shopping online (+3.1% penetration) and more often (+3.5 occasions). While online basket sizes shrank (-13%), they still exceed offline baskets in most countries (generally by a factor of 2 or more).

Globally, online purchasing differs strongly

Online buying in FMCG varies considerably: almost half of all households purchased online at least once in 2024, but online reach varies from 93% in South Korea to 2% in Morocco. Market shares of the online channel range from a high of more than 30% in two countries to less than 1% in more than a quarter of the countries included. While PL success largely aligns with its offline popularity, the difference between online and offline PL shares in many markets is substantial (sometimes as a result of PL-heavy discounters not using the online channel at all).

Online changes shopping patterns, but only slowly

A study examining consumer choices over fifteen years (2004-2019) in the United States shows that the increasing availability of online channels did impact purchase patterns in Consumer Packaged Goods, but much less than in many other sectors like fashion, music or travel.

- Online shopping penetration rose strongly (reach increased from 21% to 51%), but its market share only grew from 1% to 4%.

- Households purchased fewer unique brands, made fewer trips, and visited fewer unique retailers. These patterns were much more pronounced among younger than older consumers.

The authors attribute the decline in the size of choice sets regarding brands and retailers to lower information search costs provided by broadband internet which also contributes to more efficient offline shopping.