Promotion levels dipped in 2023 when inflation was at its peak

National brands’ conduct did not help curb the higher appeal of Private Labels in tough times

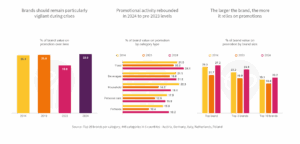

Brands should remain particularly vigilant during crises

In 2023, marked by high inflation, promotional sales as a share of brand value declined sharply. In line with past recessions, such cyclical brand behaviour (greater support in good times, reduced support in bad times) is counterproductive:

- It fails to curb the heightened appeal of private labels in tough times (Lamey et al. 2012).

- It misses the stronger returns that brand investments can generate during downturns (Steenkamp & Fang 2011).

Promotional activity rebounded in 2024 to pre-2023 levels

After a broad decline across all categories in 2023, promotions have returned—and in some cases exceeded earlier benchmarks. For the average brand in food and beverage categories more than 1 in 5 Euros spent is on deal, while deal share is only about 1 in 6 Euros in personal care.

The larger the brand, the more it relies on promotions

Brands of all sizes experienced the aforementioned reduction in the level of promotions in 2023. While the patterns are comparable, the levels are not. Larger brands always rely a bit more on promotional sales, not because they lack appeal when sold at regular prices, but because they are promoted more often.