Penetration and its variation (2): how penetration varies with time – and the importance of retailer listings

This week, we focus on the change in reach** when we double the typically used observation period of one year to two years. Additionally, we compare the reach for brands with more or fewer retailer listings.

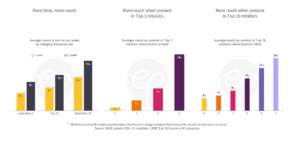

More time, more reach

A brand’s reach increases with the time period covered. Daily penetration is lower than monthly, quarterly, or yearly penetration. For the average brand in our database the two-year penetration is about 50% higher than the one-year level – a result of buyer churn and the acquisition of new buyers, but also of repurchasing by some of the existing buyers. We find a more pronounced relative increase in less frequently purchased categories: more churn (i.e. a leakier bucket) means that more buyers in any year have not purchased the brand in the previous year. It seems worthwhile to compare reach for different periods – both in terms of goal setting and to better understand the churn levels of a brand.

More reach when present in Top 3 retailers

To end up in a shopper’s basket a brand needs to be available on the shelf of the retailer a shopper visits. The chart distinguishes between brands that are available in none, one, two or three of the Top 3 retailers in a country. High reach is almost impossible without a presence in a Top 3 retailer, whereas listings in all three provides a major boost to the expected penetration levels.

More reach when present in Top 10 retailers

While getting into 5 of the Top 10 retailers in a country may sound like a big achievement, each additional listing pays off in terms of more reach. This underscores the importance of aiming to get on shelf wherever shoppers buy your category. Clearly, this relationship is bidirectional: sound marketing (meaningful innovations, impactful ads, product quality) will increase a brand’s appeal for the purchasing team of a retailer as much as for the potential shopper.