The fate of innovations – prevalence, listings and survival odds

We took a deep dive into the launch activity in 89 categories in a large Western European country. The yearly number of launches in the three years after Covid-19 dropped by about a quarter vs the three years before (from around 7500 to 5700). The share of branded launches remained stable. Interested how launches have fared in your markets and categories? Get in touch!

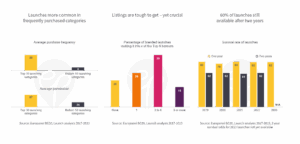

Launches more common in frequently purchased categories

Several previous picks of the week have shown that categories with more reach and more frequency boast larger assortments. More opportunities to be chosen justify the existence of a longer tail. The same is true for launch intensity. Brands (and Private Labels) launch substantially more in categories with a larger footprint:

- The Top 10 categories in terms of number of launches (launches per year: around 200) on average reach almost 90% of households who buy 20 times per year.

- The Bottom 10 categories (launches per year: around 5) on average reach one third of households who buy less than 5 times per year.

If you play in one of the former categories, your launch will have a much better chance to make it into more buyers’ consideration sets and baskets, yet it will face substantially more competition from other innovations.

Listings are tough to get – yet crucial

The larger the parent brand of a launch, the better it performs. This is a result of the brand’s strength in consumers’ minds, but also an important driver of getting on retailers’ shelves. While private label launches have a certainty to get listed (yet limited to the outlets of that retailer), listings for branded launches are hard to come by:

- A typical branded launch gets on the shelves of two out of the Top 9 retailers.

- About 1 in 5 branded launches will not be sold in any of the Top 9 retailers, and only 15% achieve a listing in more than half of these banners.

Not surprisingly, listing odds in discounters are much smaller (and listings often short-term), yet even large established supermarket chains tend to list only between 30% and 40% of branded launches.

60% of launches still available after two years

One of many success metrics of a launch (we will look at others next week) is its continued availability. While seasonal launches may have a pre-determined shelf life, a vast majority will enter the market with the aim to remain. What are the odds to achieve this ambition?

The survival rates we find are stable over time: Slightly more than 4 out of 5 launches are still on the market 12 months after their introduction, while 3 out of 5 launches survive 24 months.

How do your launches perform against these benchmarks? Do you know why they do better or worse?