Innovations: how many and who is launching?

Building on last week’s pick we revisit a Western European market and look at the companies that launch most actively. We also examine the long-term development of FMCG launch numbers in Europe.

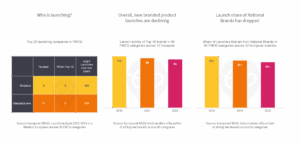

Who is launching?

Of all launches in 2022 and 2023 across 90 FMCG categories (some 11,000 in total) almost 1 in 10 was a Private Label launched by Aldi. Lidl was not far behind. This is not surprising given these retailers’ emphasis on their own label assortment and the breadth of categories which they offer. Yet, the next two positions in the ranking of most active launchers are occupied by national brand manufacturers playing in a large number of categories. The remainder of the Top 10 are retail banners again.

Do you know how you compare to your peers with respect to launch activity and the success of these launches?

Overall, new branded product launches are declining

Compared to 2019, we see a drop in the launch activity of Top 10 brands in a majority of countries. The total launch numbers fell by about 5% from 2019 to 2021 and then remained stable over the next two years, yet with major differences between countries. Given the role of innovation in preventing category commoditization and sustaining brand price premia over Private Labels, is your company doing enough to keep its innovation pipeline busy?

Launch share of National Brands has dropped long-term, but less lately

In line with the increasing market share of Private Labels in FMCG over the last ten years, their share of launches has also increased. While in 2014 the average share of branded launches across 12 markets was 62%, this share has dropped to 55% in 2024. However, the decline has slowed lately – with only a 2% decline happening since the last pre-Covid year in 2019. While a large number of launches alone will not be sufficient to stop PL growth (value for money and relevant newness of launches are essential, too) branded innovation activity is key to dampen the growth rate of PL.

Get in touch if you want to better understand the innovation numbers, prices and success benchmarks in your category.