A long-term perspective on Private Label (PL) growth: what has changed from 2014 to 2024?

We study category PL success in 12 European markets from 2014 to 2024: how much change? how common they exceed National Brand penetration? how many category shoppers buy both NB and PL?

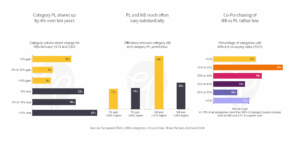

Category PL shares up by 4% over ten years

Not surprisingly, given the overall share gains by Private Labels (PL), National Brands (NB) have lost volume share in the average category—by about four percentage points over the past decade. This average, however, masks substantial variation: in two thirds of all categories, the change in share (in either direction) has exceeded five points. Moreover, in roughly one third of categories, NBs have actually gained share from PLs. While the overall trend may suggest a one-way tide favoring PLs, these results show that brand decline is not inevitable—and can, in many cases, be reversed.

PL and NB reach often vary substantially

As with individual brands, Private Label (PL) share growth is also driven by more shoppers choosing PLs . Across the 1,000 categories analyzed, the average penetration gap between NBs and PLs declined from 24% in 2014 to 15% in 2024. In 35% of categories, PLs now reach more buyers than NBs—up from 27% a decade ago.

Notably, differences in reach remain substantial: in 60% of categories, NB and PL penetration diverge by more than 20 percentage points, underscoring the heterogeneity of category dynamics.

Co-Purchasing of NB vs PL rather low

In the average category, 28% of category shoppers purchase both a national brand (NB) and a private label (PL) at least once per year—a figure that has remained virtually unchanged since 2014.

The extent of co-buying, however, varies substantially across categories. Higher purchase frequency naturally raises the likelihood that both NB and PL items find their ways into a shopper’s basket. For instance, around 60% of shoppers buy both branded and PL milk, compared with only 20% for ketchup. Co-buying is also constrained in categories where either NB or PL has limited reach—such as toothpaste or colas—and in those where the two offerings are perceived as distinctly different.

Are you aware of how these dynamics play out in your own category?