A more differentiated look at penetration: there is always room to grow

Relative penetration should be observed in more granularity: some examples how it differs across retailers and over time.

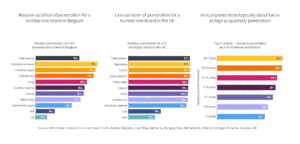

Massive variation of penetration for a number one brand in Belgium

A #1 personal care brand reaches 56% of all category buyers in Belgium. This reach hides a lot of variation: less than a quarter of category buyers at the two discounters choose that brand (maybe because of short-term listings), but also the variation in non-discounters suggests some room for improvement regarding assortment, shelf presence, or in-store activation in certain retailers.

Less variation of penetration for a number one brand in the UK

A #1 beverage brand reaches 57% of all category buyers in the UK. This reach is quite consistent across traditional retailers and their online formats, but much lower at the two biggest discounters. Is this due to short-term listings, relatively poorer shelf presence or the price gap versus these discounters’ private labels? Take a closer look at retailer differences with respect to reach – where are your weaknesses and are your competitors doing better?

Annual penetration typically about twice as high as quarterly penetration

A brand’s reach increases with the time period covered. Daily penetration is lower than monthly, quarterly, or yearly penetration. For the average brand in our database the two-year penetration is about 50% higher than the one-year level (see our Pick of the Week #344). Not surprisingly, the quarterly penetration is lower than the yearly one. How much lower depends on the category’s frequency. In very frequently purchased categories quarterly buyer churn is lower as they have more opportunities to buy again. The opposite is true in low frequency categories. Do you track your brand’s penetration for different periodicities and how is your performance relative to competitors for different periodicities?