Brands can win share – even in categories where Private Labels (PL) are growing

When PL is losing share, it is the larger brands that are more likely to win

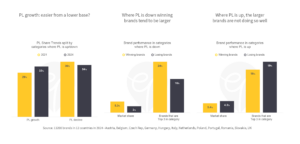

PL growth: easier from a lower base?

Not all categories are equally susceptible to Private Label success: a small perceived value gap, low performance risk or similar packaging are some of the factors traditionally linked to more PL success. However, past PL performance does not assure future success. Between 2021 and 2024 PL grew in categories that started out with an average share of 29% whereas PL declined in categories with an initial share of 36%. Are consumers satiated beyond a certain threshold – or were retailers focusing more on categories with more headroom?

Where PL is down winning brands tend to be larger

In categories where PL is declining, the brands gaining share are typically big. Among the top 20 national brands, share winners have a higher average market share (5.3%) than share losers (3.0%). Moreover, 24% of winning brands are top 3 brands, compared with only 16% of losing brands. Overall, it appears that if the heavyweight brands are performing well (we will look at some activities next week) it is more likely to affect PL performance.

Where PL is up, the larger brands are not doing so well

In categories where PL is growing, the brands gaining share are typically smaller. Among the top 20 national brands, share winners have a lower average market share (3.4%) than share losers (4.3%). Moreover, 16% of winning brands are Top 3 brands, compared with 19% of losing brands. Overall, this suggests that PL share grows in categories where the heavyweight brands are underperforming relative to their potential.